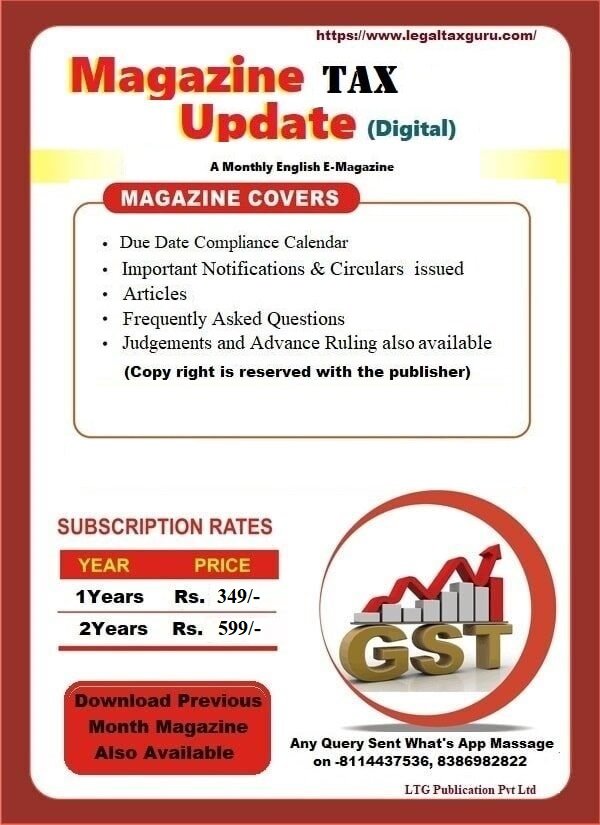

Magazine on Tax Update Part-I Dec-Jan-2024 “The Magazine Series will provide 12 parts in a year.” Online Edition: – 05.02.2024 Pages-53 Price- 35/- Click Here for Buy——– After Payment Share Receipt on 8386982822 Also Subscription Option Available For Online Payment Subscription Charges Click below link Click For Subscription of E-Tax Update E-Subscription Rates Bank […]

Uncategorized

जीएसटी अपडेट (हिन्दी) || Date of Pub. :- 16.11.2023 मासिक पत्रिका सितंबर-अक्टूबर 2023

जीएसटी अपडेट (हिन्दी) || Date of Pub. :- 16.11.2023 मासिक पत्रिका सितंबर-अक्टूबर 2023 Online Edition: 16.11.2023 Price-35/- After Payment Share Receipt on 8386982822 Also Subscription Option Available For Online Payment Subscription Charges Click below link Click For Subscription of E-Tax Update E-Subscription Rates Bank Option only 2 Year YEAR PRICE Click For Subscription of E-Tax […]

E-Magazine on Tax English or जीएसटी अपडेट (हिन्दी) मासिक पत्रिका

Magazine on Tax Update After Payment Share Receipt on 8386982822 Also Subscription Option Available For Online Payment Subscription Charges Click below link Click For Subscription of E-Tax Update E-Subscription Rates Bank Option only 2 Year YEAR PRICE Click For Subscription of E-Tax Update (After Payment Send Receipton What’s App Number- 8386982822 ) Kindly […]

महत्वपूर्ण अंतिम तिथि- जुलाई-अगस्त Important Due Dates

महत्वपूर्ण अंतिम तिथि Important Due Dates 20th जुलाई 2023 जीएसटीआर-3B (मासिक फाइलिंग) जून –2023 (पिछले वित्तीय वर्ष में 5 करोड़ रुपये से अधिक के एग्रीगेट टर्नओवर के लिए) or मासिक फाइलिंग जीएसटीआर-3B QRMP योजना का विकल्प चुनने व पिछले वित्तीय वर्ष में 5 करोड़ रुपये से तक के एग्रीगेट टर्नओवर के लिए) (तिमाही फाइलिंग) अप्रैल […]

जीएसटी अपडेट (हिन्दी) || Date of Pub. :- 31.07.2023 मासिक पत्रिका जुलाई-2023

E-जीएसटी अपडेट (हिन्दी) मासिक पत्रिका जुलाई-2023 Upcoming Date of Online Edition: 31.07.2023 Price-35/- Also Subscription Option Available Subscription Rates (Hindi) YEAR PRICE Click For Subscription (After Payment Send Receipton What’s App Number- 8386982822 ) 1 Year 299/- Subscribe 2 Year 499/- Subscribe Download Free (Hindi) Download मासिक पत्रिका फरवरी-2023 Download Download मासिक पत्रिका सितंबर-2021 […]

E-Magazine on Tax or GST Update- Hindi or English-N.K

Magazine on Tax Update After Payment Share Receipt on 8386982822 Also Subscription Option Available For Online Payment Subscription Charges Click below link E-Subscription Rates YEAR PRICE Click For Subscription of E-Tax Update (After Payment Send Receipt on What’s App Number- 8386982822 )-Kindly do not Subscribe those who have already made Subscription of Tax English E […]

Is Article 300A in favor of Individual or State Right?

Is Article 300A violate the person, body of persons or a corporation or other legal entity Right? Article 300A “No person shall be deprived of property save by authority of law.” It is most arguable human rights. The Constitution (44th Amendment) Act, 1978 eliminated the right to property from the Fundamental Rights and omitted Article […]

Reduction in threshold limit for GST E-Invoicing

Reduction in threshold limit for GST E-Invoicing Central Goods and Services Tax Rules, involving a reduction in threshold limit for GST E-Invoicing from ten crore rupees to five crore rupees, effective from August 1, 2023. Notification No. 10/2023-Central Tax Dated: 10th May, 2023 G.S.R…..(E).-In exercise of the powers conferred by sub-rule (4) of rule 48 […]

जीएसटी अपडेट मासिक पत्रिका मई-2023 Pub Date 15.05.2023

जीएसटी अपडेट मासिक पत्रिका मई-2023- Pub Date 15.05.2023 Subscription Rates (Hindi) YEAR PRICE Click For Subscription (After Payment Send Receipton What’s App Number- 8386982822 ) 1 Year 299/- Subscribe 2 Year 499/- Subscribe Bank Option only 2 Year Name- LTG Publication Pvt Ltd Bank- IDBI Bank Ltd Account Number:- 1278102000010362 IFSC Code- IBKL0001278 Branch:- A-8, Central SPI, Vidhyadhar […]

E-Magazine on Tax Update Hindi or English

Magazine on Tax Update After Payment Share Receipt on 8386982822 Also Subscription Option Available For Online Payment Subscription Charges Click below link E-Subscription Rates YEAR PRICE Click For Subscription of E-Tax Update (After Payment Send Receipton What’s App Number- 8386982822 )-Kindly do not Subscribe those who have already made Subscription of Tax English E […]