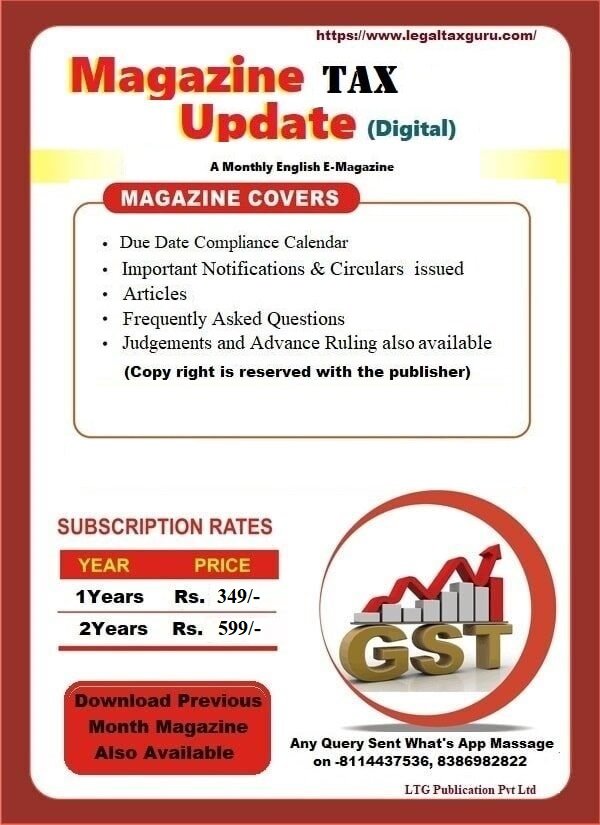

Magazine on Tax Update

After Payment Share Receipt on 8386982822

Also Subscription Option Available

For Online Payment Subscription Charges Click below link

E-Subscription Rates

Bank Option only 2 Year

| YEAR | PRICE | Click For Subscription of E-Tax Update

(After Payment Send Receipt Kindly do not Subscribe those who have already made Subscription of Tax English E Magazine Subscriber |

1 Year |

349/- |

|

2 Year |

599/- |

|

| Name- LTG Publication Pvt Ltd |

| Bank- IDBI Bank Ltd |

| Account Number:- 1278102000010362 |

| IFSC Code- IBKL0001278 |

| Branch:- A-8, Central SPI, Vidhyadhar Nagar, Jaipur Rajasthan-302039 |

| After Payment Share Receipt – 8386982822 with Name and Mail ID |

(After Payment Send Receipt on What’s App Number- 8386982822

Download Sample Tax/GST E Magazine

Download GST E-Magazine Sample Month of Dec 2022- |

|

| (Composition Scheme Special ) GST E-Magazine in English Sample |

|

Subscription Rates (Hindi)

YEAR |

PRICE |

Click For Subscription(After Payment Send Receipt

|

1 Year |

299/- |

|

2 Year |

499/- |

|

| Name- LTG Publication Pvt Ltd |

| Bank- IDBI Bank Ltd |

| Account Number:- 1278102000010362 |

| IFSC Code- IBKL0001278 |

| Branch:- A-8, Central SPI, Vidhyadhar Nagar, Jaipur Rajasthan-302039 |

| After Payment Share Receipt – 8386982822 with Name and Mail ID |

Download Free (Hindi)

|

-

भारतीय अतीत की दण्ड व्यवस्था बनाम भारत की वर्तमान दण्ड व्यवस्था ||Indian past punishment system vs present punishment system of India||Types of Punishment

Print PDF eBookजानिए अतीत की दण्ड व्यवस्था क्या थी |Know what was the punishment system of the past in india भारत में दण्ड के विकास की यात्रा अत्यंत लम्बी है | भारत की दण्ड व्यवस्था के निर्मम एवं बर्बर दण्ड से परिवीक्षा एवं भर्तसना जैसे सुधारात्मक दण्ड तक का सफ़र तय किया है | अतीत…

-

POWER OF A JUDGE TO PUT QUESTIONS TO ANY WITNESS, IN ANY FORM, AT ANY TIME

Print PDF eBookPOWER OF A JUDGE TO PUT QUESTIONS TO ANY WITNESS, IN ANY FORM, AT ANY TIME POWER OF A JUDGE TO PUT QUESTIONS TO ANY WITNESS, IN ANY FORM, AT ANY TIME Section 165 of the Indian Evidence Act, 1872 provides for the power of a judge to put questions to any witness…

-

UNION BUDGET 2024: KEY HIGHLIGHTS ON INCOME TAX

Print PDF eBookThe Union Finance Minister, Smt. Nirmala Sitharaman on Tuesday, presented her Seventh consecutive budget speech. The budget focuses on four major castes namely, ‘Garib’ (Poor), Mahilayein (Women), ‘Yuva’ (Youth), and ‘Annadata’ (Farmer). Key announcements include a thorough review of the Income-tax Act, 1961 within six months, plans to digitize all major taxpayer services…

-

E-Magazine on Tax Update Part-5 (June-2024) || Online Publication-13.07.2024

Print PDF eBookMagazine on Tax Update Part-5 (June-2024) || Online Publication-13.07.2024 Subscription Option Available Subscription for E-GST Update Rates (Hindi) YEAR PRICE Click For Subscription (After Payment Send Receipt on What’s App Number- 8386982822) 1 Year 350/- Subscribe 2 Year 600/- Subscribe legal-Tax-Guru-small Bank Option only 2 Year Name- LTG Publication Pvt Ltd Bank- IDBI Bank Ltd…

-

CBI ARRESTED A GST INSPECTOR WHILE TAKING A BRIBE FROM THE COMPLAINANT

Print PDF eBookCBI ARRESTED A GST INSPECTOR The CBI apprehended an Inspector of CGST while taking a bribe of Rs. 2.50 lakh from the complainant in Rajkot. The Complainant is an authorized person of a private entity. On 03.07.2024, the Central Board of Investigation registered a case against an Inspector of CGST in Rajkot, based…