Availability of Composition Scheme to Works Contractors

Simply put, a works contract is essentially a contract of service which may also involve supply of goods in the execution of the contract. It is basically a composite supply of both services and goods, with the service element being dominant in the contract between parties. In a general sense, a contract of works, may relate to both immovable and immovable property.

Example

- if a sub-contractor, undertakes a sub-contract for the building work, it would be a works contract in relation to immovable property. Similarly,

- if a composite supply in relation to movable property such as fabrication/painting/annual maintenance contracts etc. is undertaken, the same would come within the ambit of the broad definition of a works contract.

Availability of Composition Scheme to Works Contractors

Composition scheme is available to works contractors from April 2019 provided turnover is up to Rs.50 lakhs. Earlier, the composition scheme was not available to service providers and was open to only available to suppliers of goods under GST Law.

With the composition scheme extended to service providers, small service providers can benefit.

Composition Scheme for Services:

A Composition Scheme shall be made available for Suppliers of Services (or Mixed Suppliers) with a Tax Rate of 6% (3% CGST +3% SGST) having an Annual Turnover in the preceding Financial Year up to Rs 50 lakhs The said Scheme Shall be applicable to both Service Providers as well as Suppliers of Goods and Services, who are not eligible for the presently available Composition Scheme for Goods.

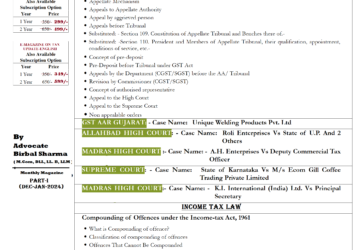

- E GST Magazine Hindi or English-Legaltaxguru

- The burden of proving the claimed Input Tax Credit lies with the purchasing dealer.

- महत्वपूर्ण अंतिम तिथि Important Due Dates month of March and April 2024

- Penalty for failure to comply with notice issued under section 142(1) or 143(2) or direction for audit under section 142(2A)

- तलाक के बाद चाइल्ड कस्टडी: सुनिश्चित करने की प्रक्रिया और कानूनी प्रमुखताएं

जीएसटी अपडेट (हिन्दी) मासिक पत्रिका

Subscription for Online Publication

for Any Query and Complaint Call- 08386982822, and Send What’s App Message-08386982822, 08114437536 E- Mail ID- legaltaxguru.com@gmail.com,

Subscription Rates (Hindi)

YEAR |

PRICE |

Click For Subscription(After Payment Send Receipt

|

1 Year |

300/- |

|

2 Year |

500/- |

|

Bank Option only 2 Year

| Name- LTG Publication Pvt Ltd |

| Bank- IDBI Bank Ltd |

| Account Number:- 1278102000010362 |

| IFSC Code- IBKL0001278 |

| Branch:- A-8, Central SPI, Vidhyadhar Nagar, Jaipur Raasthan-302039 |

| After Payment Share Receipt – 8386982822 with Name and Mail ID |

Download Free (Hindi)

|

Subscription Rates (English)

| YEAR | PRICE | Click For Subscription (After Payment Send Receipt on What’s App Number- 8386982822 ) |

| 1 Year | 250/- | Subscribe |

| 2 Year | 450/- | Subscribe |

Download Free (English)

| Download GST MAGAZINE UPDATE MONTH OF APRIL-MAY 2021 (PART-II)-Use Password- Ltgmay@1234 | Download |

| (Composition Scheme Special ) GST E-Magazine in English Sample | Download |