Power to Arrest [Section 69]

Where the Goods and Service tax Commissioner has reasons to believe that a person has committed any offence specified in clause (a) or clause (b) or clause (c) or clause (d) of sub-section (1) of section 132 of GST Act which is punishable under clause (i) or (ii) of sub-section (1), or sub-section (2) of the said section, he may, by order, authorise any officer of central tax to arrest such person. [Section 69 (1)]

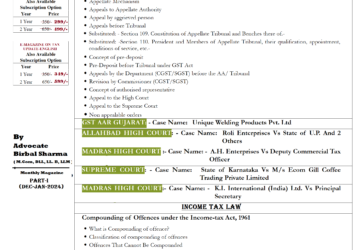

(clause (a) or clause (b) or clause (c) or clause (d) of sub-section (1) of section 132 See Page No-23 of GST MAGAZINE UPDATE MONTH OF FAB-2020 (DIGITAL) || INSPECTION, SEARCH, SEIZURE, ARREST & PUNISHMENT SPECIAL )

When offence is cognizable and non-bailable:- Where a person is arrested under sub-section (1) for an offence specified under subsection (5) of section 132 of GST Act, the officer authorised to arrest the person shall inform such person of the grounds of arrest and produce him before a Magistrate within 24 (twenty-four) hours.[Section 69 (2)]

SAFEGUARDS- (Non- cognizable and Bailable):-

Subject to the provisions of the Code of Criminal Procedure, 1973,[Section 69 (3)]––

- where a person is arrested under sub-section (1) for any offence specified under sub-section (4) of section 132 of this act, he shall be admitted to bail or in default of bail, forwarded to the custody of the Magistrate;

- in the case of a bailable and non-cognizable offence, the GST Deputy Commissioner or the GST Assistant Commissioner of shall, for the purpose of releasing an arrested person on bail or otherwise, have the same powers and be subject to the same provisions as an in charge officer of a police station.

IN the case of D.K. Basu v. State of West Bengal 1997 (1) SCC 416, the Hon’ble Supreme Court has laid down specific guidelines required to be while making arrests. See GST MAGAZINE UPDATE MONTH OF FAB-2020 (DIGITAL) || INSPECTION, SEARCH, SEIZURE, ARREST & PUNISHMENT SPECIAL )

[visibility visible_on=”desktop”][/visibility][news_box style=”1″ link=”Latest Post” link_target=”_blank” show_more=”on”][highlight][/highlight]