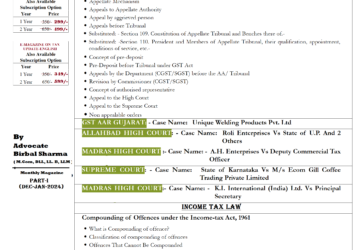

Notification Related to Due Date of Form GSTR-1, For The Period July to March-2017

1. Due Date of GST Return GSTR-1 ( Persons having aggregate turnover of up to 1.5 crore in the last year F.Y or the current F.Y)

Click Here to Download Notification No. 71/2017- Central Tax

Dated-29.12.2017

| S.No. | Period | Due Date for filing of return in Form GSTR-1 |

| 1 | July – September-2017 | 10.01.2018 |

| 2 | October – December-2017 | 15.02.2018 |

| 3 | January – March-2018 | 30.04.2018 |

2. Due Date of GST Return GSTR-1 (Persons having aggregate turnover of more than 1.5 crore rupees in the last year F.Y or the current F.y)

Click Here to Download Notification No. 72/2017- Central Tax

Dated-29.12.2017

| S.No. | Period | Due Date for filing of return in Form GSTR-1 |

| 1 | July – November-2017 | 10.01.2018 |

| 2 | December-2017 | 10.02.2018 |

| 3 | January-2018 | 10. 03.2018 |

| 4 | February-2018 | 10 .04.2018 |

| 5 | March-2018 | 10.05.2018 |

Advocate Kamlesh Kumar Kumawat

Please read point number-1st Any Registered person/ dealer who causes movement of taxable goods, as mentioned in Annexure appended to this notification, from a place outside the State to a place within the State or from a place within the State to a place outside the State