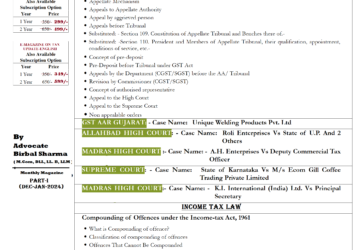

43rd GST Council Meeting Updates

The GST Council is meeting for its first meeting in after seven months meeting:-

43rd GST Council Meeting Highlights

- Trade Body and Indian Chamber of Commerce and Industry Appeals to FM to Extend Time for Filing GSTR 3B.

- GST Amnesty Scheme for all Small Taxpayers (MSME) The GST Council is likely to announce an amnesty scheme on late fee in GST return filing to provide a huge relief to small taxpayers- Due to Covid-19 pandemic:-

Pending GSTR-3B returns from July-2017 to till April 2021.

Amnesty scheme could be from 1st June 2021 till 31st August 2021. - Quarterly return monthly payment Scheme may be amended from QRMP to QRQP (Quarterly return Quarterly Payment)

- Section 50(1) of CGST Act for interest on late payment of GST on cash component only is expected to be passed at the Goods and Service Tax Council.

- Proposed to remove GST on COVID-19 vaccine, oxygen cylinder, concentrator, oximeter, PPE kite etc:

- FM- Nirmala Sitharaman Announced GST Amnesty Scheme for small taxpayers Taxpayers- ( 20.46 PM)

- The Annual Return (GSTR-9) filing will continue to be optional (turnover less than Rs. 2 crores) for FY 2020-21 for small GST taxpayers, and reconciliation statements (GSTR-9C) for 2020-21 will be furnished only by those taxpayers whose turnover is more than Rs 5 crores.

43rd gst council meeting press release- Is Waiting

[news_box style=”1″ link_target=”_blank” show_more=”on” header_background=”#c1c1c1″ header_text_color=”#511e12″]