Formats (GST Tax Invoice,GST Credit Note Format in Excel,GST Debit note format in Excel ) || Invoice Rulling

Formats (GST Tax Invoice,GST Credit Note Format in Excel,GST Debit note format…

Waiver of Late Fees GSTR-3B for the Period from July, 2017 to July, 2020.

Notification No. 57/2020 – Central Tax 30th June, 2020 G.S.R.....(E).— In exercise…

Extended GSTR-3B Due Date Extended GSTR-3B Due Date For February to August 2020

Extended GSTR-3B Due Date For February to August 2020 (Tax Payer More…

Due Dates Extended various time limits under Direct Tax & Benami laws)

Thanks for extending the last date for ITR Assessment year 2019-20 (Finanicial…

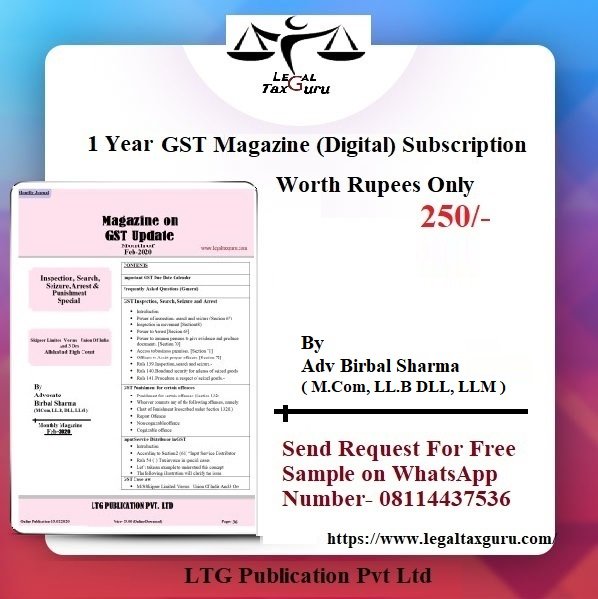

Subscription GST E-Magazine || For Free Download GST E-Magazine Sample ( Composition Scheme ) Special (Digital Download)

Subscription GST E-Magazine Subscription for Online Publication Only 250/- Rupees for 01…

Manner of furnishing of return (GSTR-3B) by short messaging service (SMS) facility

Manner of furnishing of return by short messaging service (SMS) facility CBIC…

Can a Income Tax return be filed after the due date? || If I fail to furnish my Income Tax return within the due date, will I be fined or penalized?

Can a Income Tax return be filed after the due date? Return…

Subscription GST E-Magazine ||GST E-Magazine Sample Input Tax Credit Special

Subscription GST E-Magazine Subscription for Online Publication Only 250/- Rupees for 01…

Extended Due Date for Normal Taxpayers Filing Form GSTR-3B Month of May-2020

Extended Due Date for Normal Taxpayers Filing Form GSTR-3B Month of May-2020…

Income Tax Return (Financial Year 2019-20, Tax Audit Financial Year 2019-20, Vivaad se Vishwas Scheme Extended, Date of assessments getting barred as on Sep 30, 2020, Date of assessments getting barred as on March 31)

Income Tax Return (Financial Year 2019-20, Tax Audit Financial Year 2019-20, Vivaad…