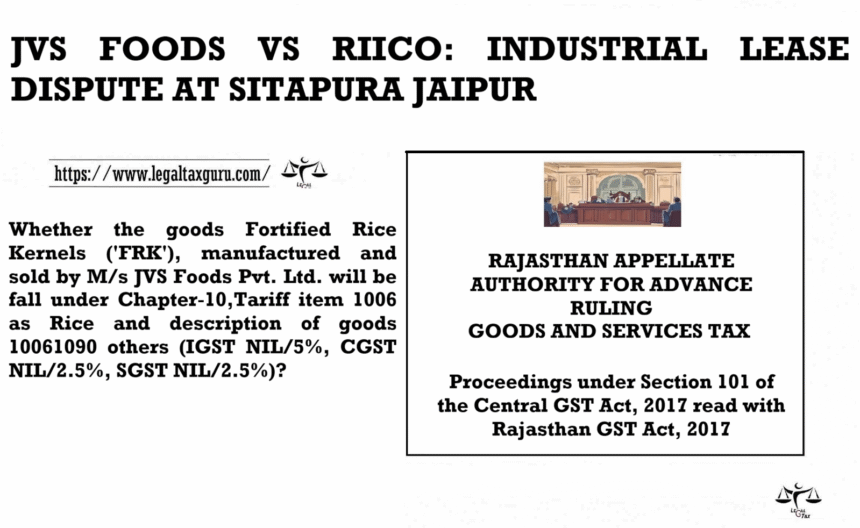

JVS FOODS VS RIICO: INDUSTRIAL LEASE DISPUTE AT SITAPURA JAIPUR

RAJASTHAN APPELLATE AUTHORITY FOR ADVANCE RULING

GOODS AND SERVICES TAX

Proceedings under Section 101 of the Central GST Act, 2017 read with Rajasthan GST Act, 2017

Before the Bench of

Sh. Pramod Kumar Singh, Member (Central Tax)

Dr. Preetam B. Yashvant, Member (State Tax)

Case Title :- M/s JVS Food Pvt. Ldt.(GST AAAR RAJASTHAN)

Appeal No. RAJ/AAAR/APP/04/2019-20

Against Advance Ruling No. RAJ/AAR/2019-20/27 dated 28.11.2019

Order No. RAJ/AAAR/6/2019-20

Date of Judgment/ Order- 1st April 2020

IMPORTANT PARAS

Para no. 1. At the outset, we would like to make it clear that the provisions of both the Central GST Act, 2017 and the Rajasthan GST Act, 2017 are same except for certain provisions. Therefore, unless a mention is specifically made to such dissimilar provisions, a reference to the Central GST Act, 2017 would also mean a reference to the same provisions under Rajasthan GST Act, 2017.

Para no. 2. The present appeal has been filed under Section 100 of the Central GST Act, 2017 (hereinafter also referred to as ‘the CGST Act’) read with Section 100 of the Rajasthan GST Act, 2017 (hereinafter also referred to as ‘the RGST Act’) by M/s JVS Foods Pvt. Ltd., G-220, Sitapura Industrial Area, Jaipur, Rajasthan (hereinafter also referred to as ‘the Appellant’) against the Advance Ruling No. RAJ/AAR/2019-20/27, dated 28.11.2019.

Para no. 7. We find that the appellant vide its application filed before the Rajasthan Authority for Advance Ruling, had requested for Advance Ruling on the following point:-

Whether the goods Fortified Rice Kernels (‘FRK’), manufactured and sold by M/s JVS Foods Pvt. Ltd. will be fall under Chapter-10,Tariff item 1006 as Rice and description of goods 10061090 others (IGST NIL/5%, CGST NIL/2.5%, SGST NIL/2.5%)?

Para no. 10. During the course of the personal hearing the appellant reiterated the points as stated in Grounds of Appeal and also submitted additional submissions.

Para no. 13. It is further observed that the Appellant’s main contention is that the Fortified Rice Kernels has the essential character of Natural Rice and classifiable under HSN 1006 as Rice. To arrive at any conclusion of the said claim of the appellant, we find it imperative to go through the process of manufacturing of FRK. We find that, first, the natural rice is converted to flour form, then, the premix of vitamin-mineral is added to it. Post mix, the prepared material is passed through a machine which converts it back in to granule shape similar to rice, which are known as Fortified Rice Kernel (FRK). The FRK is packed in a 25Kg bag to be further supplied to various millers/suppliers with instruction “this product should be first mixed (blended) with traditional rice in ratlo of 1:100 and then the mixed rice is cooked and consumed.”

Para no. 15. We also note that the appellant supplied the FRK to various millers/suppliers with instruction “this product should be first mixed (blended) with traditional rice in ratio of 1:100 and then the mixed rice is cooked and consumed. “This is an admission of fact by the appellant that FRK is a product different from the traditional rice and to be used for blending in traditional rice.

Para no. 16. The appellant has also contended that the AAR has not considered the heading pertaining to “Puffed rice, commonly known as Muri, flattened or beaten rice, commonly known as Chira, parched rice, commonly known as khoi, parched paddy or rice coated with sugar or gur, commonly known as Murki” which attracted Nil rate of duty and is addition to HSN in GST Tariff. We find that the product FRK does not fall in the category of “Puffed rice, commonly known as Muri, flattened or beaten rice, commonly known as Chira, parched rice, commonly known as khoi, parched paddy or rice coated with sugar or gur, commonly known as Murki”.

Para no. 17. In view of above we arrive at the conclusion that the FRK manufactured by the appellant do not have essential character of natural Rice and also does not merit classification under Chapter 10 in terms of Chapter Note 1(A) of the said Chapter. It is appropriately classifiable under the sub-heading of Chapter 19 i.e. under Chapter sub-heading 19049000.

Para no. 18. While arriving to the above conclusion, we have considered all the relevant arguments and submissions put forth by the appellant. We don’t find their submissions, mentioned at Para 6 (vi and vii) above, relevant to the present appeal.

Para no. 19. The appeal stands disposed accordingly.