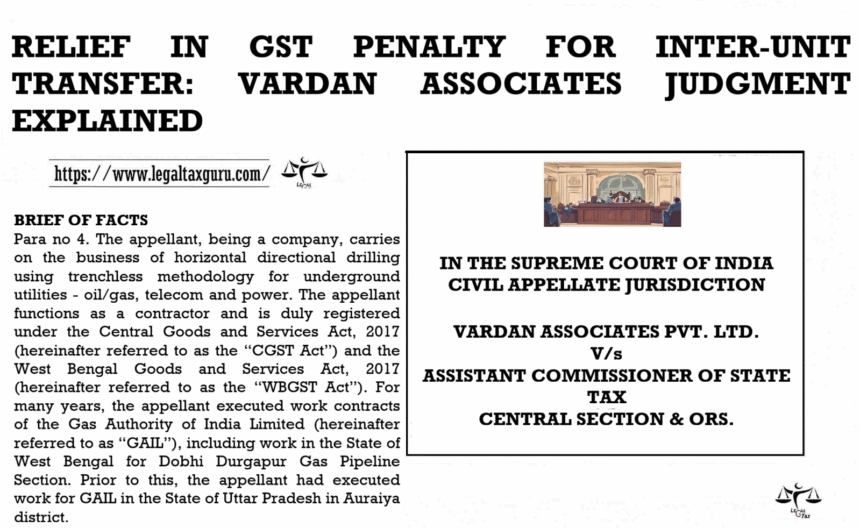

RELIEF IN GST PENALTY FOR INTER-UNIT TRANSFER: VARDAN ASSOCIATES JUDGMENT EXPLAINED

IN THE SUPREME COURT OF INDIA

CIVIL APPELLATE JURISDICTION

VARDAN ASSOCIATES PVT. LTD.

VERSUS

ASSISTANT COMMISSIONER OF STATE TAX

CENTRAL SECTION & ORS.

CIVIL APPEAL NO. 8302 of 2023

SPECIAL LEAVE PETITION (C) NO. 21079 OF 2022

DATE OF JUDGEMENT : 31st October 2023

HEADNOTES

This appeal has been preferred against the final judgment and order passed by the learned Single Judge of the High Court at Calcutta by which the said petition was dismissed. HELD-The appeal stands disposed of.

BRIEF OF FACTS

Para no 4. The appellant, being a company, carries on the business of horizontal directional drilling using trenchless methodology for underground utilities – oil/gas, telecom and power. The appellant functions as a contractor and is duly registered under the Central Goods and Services Act, 2017 (hereinafter referred to as the “CGST Act”) and the West Bengal Goods and Services Act, 2017 (hereinafter referred to as the “WBGST Act”). For many years, the appellant executed work contracts of the Gas Authority of India Limited (hereinafter referred to as “GAIL”), including work in the State of West Bengal for Dobhi Durgapur Gas Pipeline Section. Prior to this, the appellant had executed work for GAIL in the State of Uttar Pradesh in Auraiya district.

IMPORTANT PARAGRAPHS

Para No.17. Having considered the matter, the Court wishes to confine its consideration only to the quantum of penalty, as was made clear vide order dated 8th December, 2022. It is not in doubt that stricto sensu, the appellant cannot shirk from its responsibility of complying with the requirement in law to generate a fresh E-way bill, if for any reason the consignment had not been transported. However, viewing the factual scenario, which is not disputed, i.e., the appellant is the owner of the consignment and was using it in connection with its contractual obligations in Uttar Pradesh and then having a similar contract in West Bengal and no evidence has been placed on record that shows that the consignment was to be sold/used for any other purpose in respect of any other party, this Court is persuaded to interference.

Para No. 18. The appellant has been saddled with the tax amount of ₹ 54,00,000/- (Rupees Fifty four lakhs). The law also provides for imposition of penalty. Ordinarily, we may have refrained from interfering, but because there was an E-way bill that was generated and in view of the discussions made hereinabove, we are inclined to vary the orders passed by the High Court.

Para no. 19. In our opinion, ends of justice would be served if the penalty amount is reduced to 50% of the penalty imposed, i.e., ₹27,00,000/- (Rupees Twenty seven lakhs). Therefore, ₹54,00,000/-(Rupees Fifty four lakhs) being the tax imposed, is upheld and penalty would now be ₹27,00,000/- (Rupees Twenty seven lakhs), totalling to ₹81,00,000/- (Rupees Eighty one lakhs), which shall be paid by the appellant. The said amount, subject to payment(s) already made, shall be deposited with the concerned Authority on or before 29th February, 2024. Upon the same being done, the transportation vehicle as also the consignment shall be released to their rightful owners expeditiously. At the same time, the appellant is cautioned to be vigilant in future.

ORDER

Para no 20. The appeal stands disposed of in the afore-elucidated terms. It is made clear that this order has been passed under Article 142 of the Constitution of India and shall not be treated as a precedent. Pending application stands disposed of.