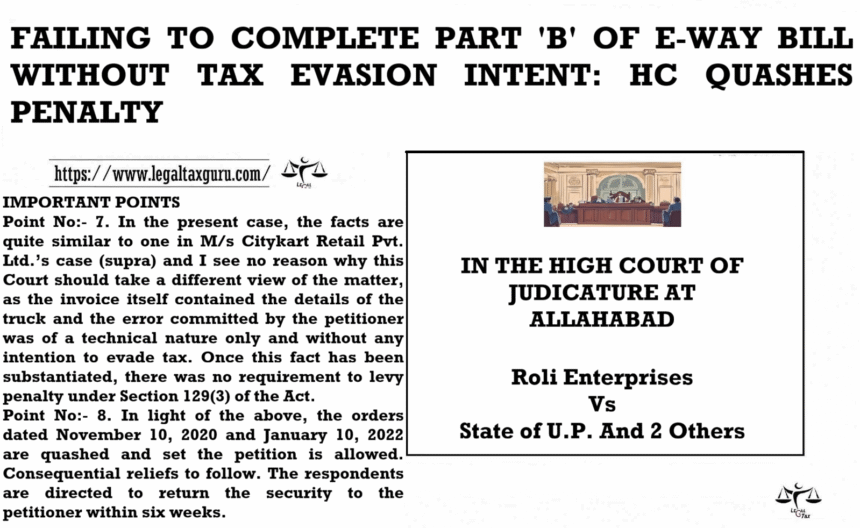

FAILING TO COMPLETE PART ‘B’ OF E-WAY BILL WITHOUT TAX EVASION INTENT: HC QUASHES PENALTY

IN THE HIGH COURT OF JUDICATURE AT

ALLAHABAD

Roli Enterprises

Vs

State of U.P. And 2 Others

Appeal Number: Writ Tax No. – 937 of 2022

Date of Judgement/Order: 16th January 2024

BRIEF FACTS

The Allahabad High Court has delivered a judgment in the case of Roli enterprises v. State of U.P. & Ors. where the petitioner challenged a penalty levied under Section 129(3) of the Uttar Pradesh Goods and Services Tax Act, 2017. The penalty was imposed for the non-completion of Part ‘B’ of the e-Way Bill.

IMPORTANT POINTS

Point No:- 7. In the present case, the facts are quite similar to one in M/s Citykart Retail Pvt. Ltd.’s case (supra) and I see no reason why this Court should take a different view of the matter, as the invoice itself contained the details of the truck and the error committed by the petitioner was of a technical nature only and without any intention to evade tax. Once this fact has been substantiated, there was no requirement to levy penalty under Section 129(3) of the Act.

Point No:- 8. In light of the above, the orders dated November 10, 2020 and January 10, 2022 are quashed and set aside the petition is allowed. Consequential reliefs to follow. The respondents are directed to return the security to the petitioner within six weeks.