Coaching Service with Goods is Composite Supply & not mixed supply: AAAR

Coaching Service with Goods is CompositeSupply & not mixed supply: AAAR RAJASTHAN…

MRITUNJAY KUMAR GST CASE LAW- TIME LIMIT FOR ITC

MRITUNJAY KUMAR GST CASE LAW- TIME LIMIT FOR ITC DELHI HIGH COURT…

Invoice Irregularities vs. ITC Entitlement – Delhi High Court’s Clarification

Invoice Irregularities vs. ITC Entitlement – Delhi High Court’s Clarification M/S B…

PERSONAL HEARING MANDATORY FOR PASSED ADVERSE GST ORDERS: MADRAS HIGH COURT

PERSONAL HEARING MANDATORY FOR PASSED ADVERSE GST ORDERS MADRAS HIGH COURT…

Bombay High Court Invalidates GST Demand on Ocean Freight- Bombay High Court

Bombay High Court Invalidates GST Demand on Ocean Freight Bombay High Court…

Whether the Appellate authority can dismiss the appeal on the ground of limitation without offering an opportunity of being heard? and the period for filing the appeal can be extended by the Appellate Authority(CALCUTTA HIGH COURT)

Appeal Cannot Be Dismissed Without Hearing on Limitation: Calcutta HC CALCUTTA HIGH…

Jurisdictional limit of the GST & Central Excise Superintendent regarding orders exceeding ₹10,00,000 (ALLAHABAD HIGH COURT)

JURISDICTIONAL LIMIT OF THE GST & CENTRAL EXCISE SUPERINTENDENT REGARDING ORDERS EXCEEDING…

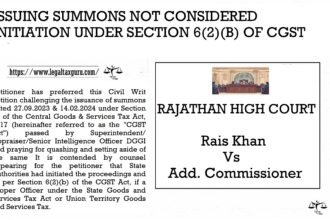

SUMMON NOT IN VIOLATION OF SECTION 6(2) (B) OF THE CGST ACT, 2017 AND – ISSUING SUMMONS NOT CONSIDERED INITIATION UNDER SECTION 6(2)(B) OF CGST ACT.

ISSUING SUMMONS NOT CONSIDERED INITIATION UNDER SECTION 6(2)(B) OF CGST ACT. RAJATHAN…

Kerala HC:- Section 16(4) GST ITC Deadline to November 30 with effect from July-2017

Section 16(4) GST ITC Deadline to November 30 with effect from July-2017…

ITC IS AVAILABLE FOR BUILDINGS CONSTRUCTED FOR LEASING PURPOSES. SUCH CONSTRUCTION CANNOT BE CONSIDERED AS BEING FOR THE TAXPAYER’S “OWN ACCOUNT”

Construction for Leasing Not for Own Use – ITC Claim Valid Chief…