|

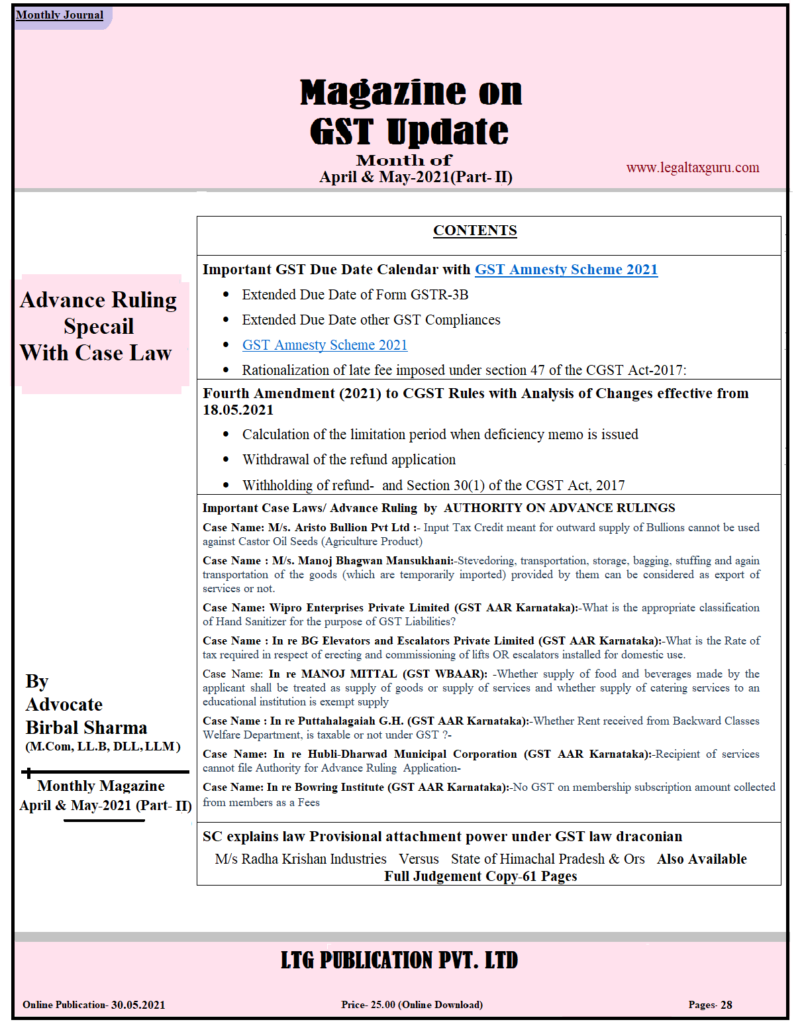

Important GST and other Due Date Calendar |

|

Due Date Calendar APRIL-22&MAY-22 |

|

|

10th April 2022 |

GSTR 7 (Monthly) for March 2022 (filed by the e-commerce operators who are required to deduct Tax Deducted at Source (TDS) under GST) |

|

10th April 2022 |

GSTR 8 (Monthly) for March 2022 (filed by the e-commerce operators who are required to deduct Tax Collected at Source (TCS) under GST) |

|

11th April 2022 |

GSTR 1 (Monthly) for March 2022 |

|

13thApril 2022 |

GSTR 1 IFF or QRMP Jan to March 2022 |

|

13th April 2022 |

GSTR 6 (Monthly) for March 2022 (Input Service Distributors) |

|

18th April 2022 |

CMP-08 Jan-March 2021 GST Return for composition Taxpayers |

|

20thApril 2022 |

GSTR 5, 5A (Monthly) for March 2022 (Non-Resident Taxpayers and ODIAR services provider) |

|

20th April 2022 |

GSTR 3B for March-2022 for Monthly |

|

22th April 2022 |

GSTR 3B (Jan to March, 2022) – Less than Rs 5 crore or QRMP scheme

for South India: – Chhattisgarh, Madhya Pradesh, Gujarat, Dadra and Nagar Haveli and Daman and Diu, Maharashtra, Karnataka, Goa, Lakshadweep, Kerala, Tamil Nadu, Puducherry, Andaman and Nicobar Islands, Telangana and Andhra Pradesh |

|

24th April 2022 |

GSTR 3B (Jan to March, 2022) – Less than Rs 5 crore or QRMP scheme for North India: – Jammu and Kashmir, Ladakh, Himachal Pradesh, Punjab, Chandigarh, Uttarakhand, Haryana, Delhi, Rajasthan, Uttar Pradesh, Bihar, Sikkim, Arunachal Pradesh, Nagaland, Manipur, Mizoram, Tripura, Meghalaya, Assam, West Bengal, Jharkhand and Odisha |

|

25th April 2022 |

ITC-04 (Half-yearly- Oct-21-Mar-2022) |

|

30th April 2022 |

GSTR-4 FY 2021-22 Yearly return for composition Taxpayers scheme |

|

30th April 2022 |

TDS Payment for the month of March-2022 |

|

10th May 2022 |

GSTR 7 (Monthly) for April 2022 (filed by the e-commerce operators who are required to deduct Tax Deducted at Source (TDS) under GST) |

|

10th May 2022 |

GSTR 8 (Monthly) for April 2022 (filed by the e-commerce operators who are required to deduct Tax Collected at Source (TCS) under GST) |

|

11th May 2022 |

GSTR 1 (Monthly) for April 2022 |

|

13th May 2022 |

GSTR 6 (Monthly) for April 2022 (Input Service Distributors) |

|

20th May 2022 |

GSTR 3B for April 2022 for Monthly |

|

25th May 2022 |

GST Challan Payment if no sufficient ITC for Apr (for all Quarterly Filers) |

|

30th May 2022 |

Form 11 for LLP (MCA) F.Y 2021-22 |

|

31th May 2022 |

TDS Return for Jan to March- 2022 |

E-Magazine on GST Update in Hindi or English

Subscription for Online Publication

A Complete Magazine on GST

|

Subscription for Online Publication

for Any Query and Complaint Call- 08386982822, and Send What’s App Message-08386982822, 08114437536 E- Mail ID- legaltaxguru.com@gmail.com,

Subscription Rates (English)

| YEAR | PRICE | Click For Subscription (After Payment Send Receipt on What’s App Number- 8386982822 ) |

| 1 Year | 250/- |

|

| 2 Year | 450/- |

|

Download Free (English)

|

Download GST MAGAZINE UPDATE MONTH OF APRIL-MAY 2021 (PART-II)-Use Password- Ltgmay@1234

|

|

| (Composition Scheme Special ) GST E-Magazine in English Sample |

Bank Option only 2 Year

| Name- LTG Publication Pvt Ltd |

| Bank- IDBI Bank Ltd |

| Account Number:- 1278102000010362 |

| IFSC Code- IBKL0001278 |

| Branch:- A-8, Central SPI, Vidhyadhar Nagar, Jaipur Raasthan-302039 |

| After Payment Share Receipt – 8386982822 with Name and Mail ID |

Use Password- Ltgmay@1234

Subscription Rates (Hindi)

YEAR |

PRICE |

Click For Subscription(After Payment Send Receipt

|

1 Year |

300/- |

|

2 Year |

500/- |

|

| Name- LTG Publication Pvt Ltd |

| Bank- IDBI Bank Ltd |

| Account Number:- 1278102000010362 |

| IFSC Code- IBKL0001278 |

| Branch:- A-8, Central SPI, Vidhyadhar Nagar, Jaipur Raasthan-302039 |

| After Payment Share Receipt – 8386982822 with Name and Mail ID |

Download Free (Hindi)

|

-

- SUPREME COURT CLARIFIES DEPRECIATION ON NON-COMPETE FEE U/S 32(1)(ii) OF INCOME TAX ACT

- Supreme Court Issues Directions for Cataloguing Witnesses and Documentary Evidences in Criminal Trial: Manojbhai Jethabhai Parmar Case

- Head Office Expenditure of Non-Resident Companies in Relation to Indian Business Subject to the Deduction Cap Prescribed u/s 44C: Supreme Court

- SUPREME COURT FINDINGS ON PRE-IMPORT CONDITIONS & IGST EXEMPTIONS

- SUPREME COURT FINDINGS ON THE LEVY OF GST ON OCEAN FREIGHT: GST COUNCIL RECOMENDATIONS

-

- SUPREME COURT CLARIFIES DEPRECIATION ON NON-COMPETE FEE U/S 32(1)(ii) OF INCOME TAX ACT

- Supreme Court Issues Directions for Cataloguing Witnesses and Documentary Evidences in Criminal Trial: Manojbhai Jethabhai Parmar Case

- Head Office Expenditure of Non-Resident Companies in Relation to Indian Business Subject to the Deduction Cap Prescribed u/s 44C: Supreme Court

- SUPREME COURT FINDINGS ON PRE-IMPORT CONDITIONS & IGST EXEMPTIONS

- SUPREME COURT FINDINGS ON THE LEVY OF GST ON OCEAN FREIGHT: GST COUNCIL RECOMENDATIONS

-

- SUPREME COURT CLARIFIES DEPRECIATION ON NON-COMPETE FEE U/S 32(1)(ii) OF INCOME TAX ACT

- Supreme Court Issues Directions for Cataloguing Witnesses and Documentary Evidences in Criminal Trial: Manojbhai Jethabhai Parmar Case

- Head Office Expenditure of Non-Resident Companies in Relation to Indian Business Subject to the Deduction Cap Prescribed u/s 44C: Supreme Court

- SUPREME COURT FINDINGS ON PRE-IMPORT CONDITIONS & IGST EXEMPTIONS

- SUPREME COURT FINDINGS ON THE LEVY OF GST ON OCEAN FREIGHT: GST COUNCIL RECOMENDATIONS

-

- SUPREME COURT CLARIFIES DEPRECIATION ON NON-COMPETE FEE U/S 32(1)(ii) OF INCOME TAX ACT

- Supreme Court Issues Directions for Cataloguing Witnesses and Documentary Evidences in Criminal Trial: Manojbhai Jethabhai Parmar Case

- Head Office Expenditure of Non-Resident Companies in Relation to Indian Business Subject to the Deduction Cap Prescribed u/s 44C: Supreme Court

- SUPREME COURT FINDINGS ON PRE-IMPORT CONDITIONS & IGST EXEMPTIONS

- SUPREME COURT FINDINGS ON THE LEVY OF GST ON OCEAN FREIGHT: GST COUNCIL RECOMENDATIONS

-

- SUPREME COURT CLARIFIES DEPRECIATION ON NON-COMPETE FEE U/S 32(1)(ii) OF INCOME TAX ACT

- Supreme Court Issues Directions for Cataloguing Witnesses and Documentary Evidences in Criminal Trial: Manojbhai Jethabhai Parmar Case

- Head Office Expenditure of Non-Resident Companies in Relation to Indian Business Subject to the Deduction Cap Prescribed u/s 44C: Supreme Court

- SUPREME COURT FINDINGS ON PRE-IMPORT CONDITIONS & IGST EXEMPTIONS

- SUPREME COURT FINDINGS ON THE LEVY OF GST ON OCEAN FREIGHT: GST COUNCIL RECOMENDATIONS