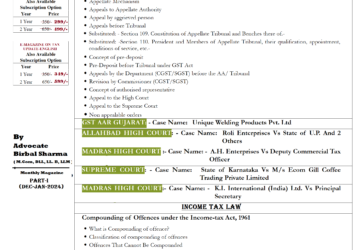

Chart of Punishment Prescribed under Section 132(1) Under GST Law

- Chart of Punishment Prescribed under Section 132(1)

| Clause | Amount of Evasion (in Rupees.) | Particular | Term of Imprisonment |

|---|---|---|---|

|

(i) |

Above 5 Crore

|

The amount of tax evasion/ Wrongly availment/utilization of Input tax credit/ Refund |

Imprisonment of a term which may extend to 5 Years and fine [minimum 6 months (Sec 132 (3)] |

|

(ii) |

Duty/Tax evasion Above 2 Crore but below 5 Crore |

The amount of tax evasion/Wrongly availment/utilization of Input tax credit/ Refund |

Imprisonment of a term which may extend to 3 Years and fine [minimum 6 months (Sec 132 (3)] |

|

(iii) |

Duty/Tax evasion Above 1 Cr but below 2 Crore |

The amount of tax evasion/ Wrongly availment/utilization of Input tax credit/ Refund |

Imprisonment of a term which may extend to to 1 Year with fine [minimum 6 months (Sec 132 (3)] |

|

(iv) |

|

Where one commits or abets the commission of offence specified in clause (f) or (g) or (j)(Falsifies/ Obstructs/ Tampers) |

Imprisonment of a term which may extend to 6 months or with fine or with both. |

Repeat Offences:

Where any person convicted of an offence under this section is again convicted of an offence, then he shall be punishable for the second and for every subsequent offence with imprisonment for a term which may extend to five years and with fine.[ Section 132(2) ] •

- The imprisonment referred to in clauses (i), (ii) and (iii) of sub-section (1) and sub-section (2) shall, in the absence of special and adequate reasons to the contrary to be recorded in the judgment of the Court, be for a term not less than six months. [Section 132(3)]

- Non-cognizable offence: Other offences under the Act, except the offences referred to in Section 132(5) are non-cognizable and bailable Section 132 (4)

- Cognizable offence: All offences specified in clause (a) or clause (b) or clause (c) or clause (d) of sub-section (1) and punishable under clause (i) of that sub-section where the amount of tax evaded exceeds Rs. 5 crores, shall be cognizable and non-bailable Section 132 (5)

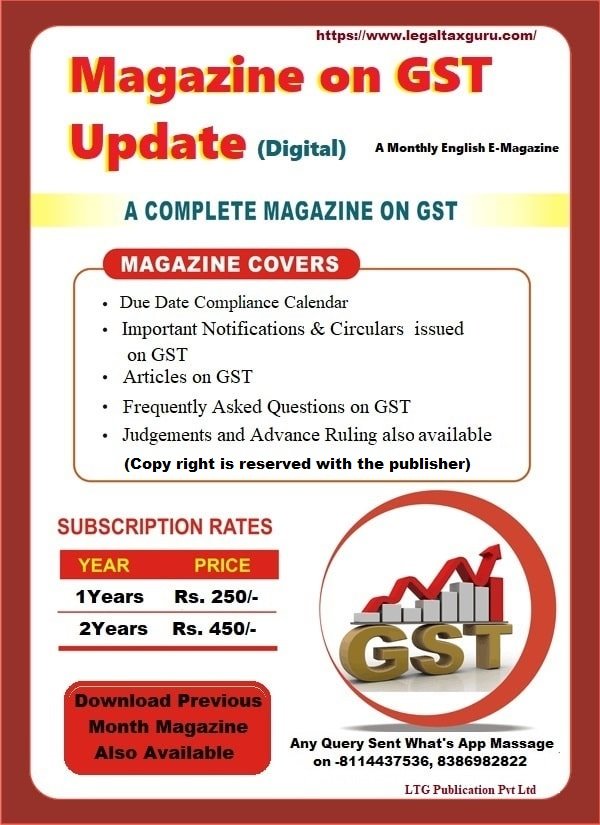

- E GST Magazine Hindi or English-Legaltaxguru

- The burden of proving the claimed Input Tax Credit lies with the purchasing dealer.

- महत्वपूर्ण अंतिम तिथि Important Due Dates month of March and April 2024

- Penalty for failure to comply with notice issued under section 142(1) or 143(2) or direction for audit under section 142(2A)

- तलाक के बाद चाइल्ड कस्टडी: सुनिश्चित करने की प्रक्रिया और कानूनी प्रमुखताएं