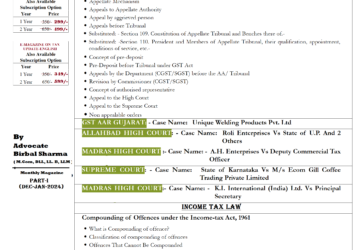

Relaxation in filing of GST Return

- Relaxation in filing of annual returns for MSMEs for Financial Year- 2017-18 and Financial Year 2018-19 as under:

- a. waiver of the requirement of filing annual returns FORM GSTR-9A for Composition Taxpayers for the said tax periods; and

- b. filing of annual returns FORM GSTR-9 for those taxpayers who (are required to file the said return but) have aggregate turnover up to 2 crores rupees made optional for the said tax periods.

- A GST Committee of Officers to be constituted to examine the simplification of Forms for Annual (GSTR-9 ) Return and reconciliation statement (GSTR-9C).

- Extension of last date for filing of GST appeals against orders of Appellate Authority before the Goods and Service tax Appellate Tribunal as the Appellate Tribunals are yet not functional.

- In order to nudge GST taxpayers to timely file their statement of outward supplies on portal, imposition of restrictions on availment of input tax credit (ITC) by the recipients in cases where details of outward supplies are not furnished by the suppliers in the statement under section 37 of the Goods and Services Tax Act, 2017.

- New return system now to be introduced from April, 2020 (earlier proposed from October, 2019), in order to give ample opportunity to taxpayers as well as the system to adapt and accordingly specifying the due date for furnishing of return in GST Return FORM GSTR-3B and details of outward supplies in GST Return FORM GSTR-1 for the period October, 2019 – March, 2020.

- Issuance of GST circulars for uniformity in application of law across all jurisdictions:

- a. procedure to claim refund in GST FORM GST RFD-01A subsequent to favourable order in appeal or any other forum;

- b. eligibility to file a refund application in GST FORM GST RFD-01A for a period and category under which a NIL refund application has already been filed; and

- c. clarification regarding supply of ITES services (Information Technology enabled Services) (in supersession of GST Circular No. 107/26/2019-GST dated 18, July 2019) being made on own account or as intermediary.

- Rescinding of Circular No.105/24/2019-GST dated 20, June 2019, ab-initio, which was issued in respect of post-sales discount.

- Suitable amendments in CGST Act, UTGST Act, and the corresponding SGST Acts in view of creation of UTs of Jammu & Kashmir and Ladakh.

- Integrated refund system with disbursal by single authority to be introduced from 24 Sep 2019

- In principle decision to Aadhar link with GST registration of taxpayers under GST and examine the possibility of making Aadhar mandatory for claiming GST refunds.

- In order to tackle the menace of fake GST invoices and fraudulent GST refunds, in principle decision to prescribe reasonable restrictions on passing of credit by risky GST taxpayers including risky new gst taxpayers.

Note: The recommendations of the GST Council have been presented in this release in simple language only for immediate information of all stakeholders. The same would be given effect through relevant GST Notifications/ Circulars/ on site which alone shall have the force of law.

Other Ralted Post

Important Points for GST Return and Late Fees

(If you liked the Article, please Subscribe )