Good News: CBIC extends 3 due dates- Amnesty Scheme Further Extended and Time Limit for Revocation of Cancelled GST Registrations and GSTR-3B and FORM GSTR-1/ IFF on 29th August 2021

- The filing of FORM GSTR-3B and FORM GSTR-1/ IFF by companies using electronic verification code (EVC), instead of Digital Signature certificate (DSC) has already been enabled for the period from 27.04.2021 to 31.08.2021. This has been further extended to 31st October, 2021. [Refer Notification No. 32/2021- Central Tax, dated 29.08.2021].

Notification No. 32/2021 – Central Tax New Delhi, Dated the 29 th August, 2021

G.S.R…(E).- In exercise of the powers conferred by section 164 of the Central Goods and Services Tax Act, 2017 (12 of 2017), the Government, on the recommendations of the Council, hereby makes the following rules further to amend the Central Goods and Services Tax Rules, 2017, namely: —

- Short title and commencement. –

- These rules may be called the Central Goods and Services Tax (Seventh Amendment) Rules, 2021.

- Save as otherwise provided in these rules, they shall come into force on the date of their publication in the Official Gazette.

- In the Central Goods and Services Tax Rules, 2017, —

(i) in sub-rule (1) of rule 26, –

(a) in the fourth proviso, for the figures, letters and words “31st day of August, 2021”, the figures, letters and words “31st day of October, 2021” shall be substituted;

(b) with effect from the 1 st day of November, 2021, all the provisos shall be omitted;

(ii) with effect from the 1st day of May, 2021, in rule 138E, after the fourth proviso, the following proviso shall be inserted, namely: – “Provided also that the said restriction shall not apply during the period from the 1 st day of May, 2021 till the 18th day of August, 2021, in case where the return in FORM GSTR-3B or the statement of outward supplies in FORM GSTR-1 or the statement in FORM GST CMP-08, as the case may be, has not been furnished for the period March, 2021 to May, 2021.”;

(iii) in FORM GST ASMT-14, –

- after the words, “with effect from ——”, the words, “vide Order Reference No. ——-, dated ——” shall be inserted;

- the words, “for conducting business without registration despite being liable for registration” shall be omitted;

- at the end after “Designation”, the word “Address” shall be inserted.

[F. No. CBIC-20006/24/2021-GST]

2. The Government, vide Notification No. 19/2021- Central Tax, dated 01.06.2021, had provided relief to the taxpayers by reducing / waiving late fee for non-furnishing FORM GSTR-3B for the tax periods from July, 2017 to April, 2021, if the returns for these tax periods are furnished between 01.06.2021 to 31.08.2021, This has been further extended (FORM GSTR-3B late fee GST Amnesty Scheme 2021) from 31.08.2021 up to 30.11.2021. [Refer Not. No. 33/2021- Central Tax, dated 29.08.2021].

Read more for GST Amnesty Scheme 2021 click below link

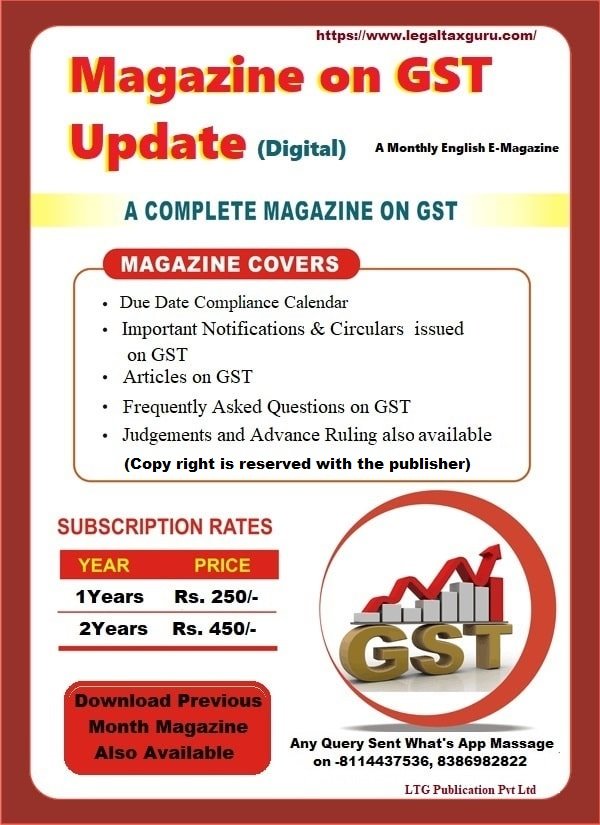

Click on Image for more (Magazine on GST Update)……..

Notification No. 33/2021 – Central Tax New Delhi, the 29 th August, 2021 G.S.R…..(E).—

In exercise of the powers conferred by section 128 of the Central Goods and Services Tax Act, 2017 (12 of 2017), the Government, on the recommendations of the Council, hereby makes the following further amendments in the notification of the Government of India in the Ministry of Finance (Department of Revenue), No. 76/2018– Central Tax, dated the 31st December, 2018, published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i) vide number G.S.R. 1253(E), dated the 31st December, 2018,

namely:– In the said notification, in the ninth and tenth provisos, for the figures, letters and words ―31st day of August, 2021‖, where ever they occur, the figures, letters and words ―30th day of November, 2021‖ shall be substituted.

[F. No. CBIC-20006/24/2021-GST]

3. Extend timelines for filing of application for revocation of cancellation of GST registration to 30.09.2021, where due date for filing such application falls between 01.03.2020 to 31.08.2021, in cases where registration has been cancelled under clause (b) or clause (c) of section 29(2) of the CGST Act. [Refer Not. No. 34/2021- Central Tax, dated 29.08.2021].

Notification No. 34/2021 – Central Tax New Delhi, the 29 th August, 2021 G.S.R…..(E).–

In partial modification of the notifications of the Government of India in the Ministry of Finance (Department of Revenue), No. 35/2020-Central Tax, dated the 3 rd April, 2020, published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i), vide number G.S.R. 235(E), dated the 3 rd April, 2020 and No. 14/2021-Central Tax, dated the 1 st May, 2021, published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i), vide number G.S.R. 310(E), dated the 1 st May, 2021, in exercise of the powers conferred by section 168A of the Central Goods and Services Tax Act, 2017 (12 of 2017) (hereafter in this notification referred to as the said Act), read with section 20 of the Integrated Goods and Services Tax Act, 2017 (13 of 2017), and section 21 of the Union Territory Goods and Services Tax Act, 2017 (14 of 2017), the Government, on the recommendations of the Council, hereby notifies that where a registration has been cancelled under clause (b) or (c) of sub-section (2) of section 29 of the said Act and the time limit for making an application of revocation of cancellation of registration under sub-section (1) of section 30 of the said Act falls during the period from the 1 st day of March, 2020 to 31st day of August, 2021, the time limit for making such application shall be extended upto the 30th day of September, 2021.

[F. No. CBIC-20006/24/2021-GST]

Click below link for View Procedure for Revocation of cancellation GST Registration

[news_box style=”1″ title=”Latest Post” link_target=”_blank” show_more=”on” header_background=”#a8a8a8″ header_text_color=”#770000″]