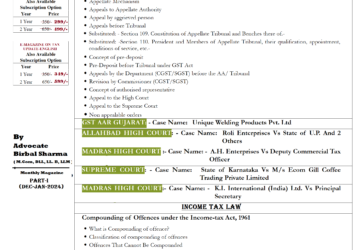

Extended Due Date for Normal Taxpayers Filing Form GSTR-3B Month of May-2020

Extended GSTR-3B due date for may 2020:- Person having aggregate turnover above 5 Cr. Rupees in preceding Financial Year (Notification No. 36/2020 – Central Tax 3rd April, 2020)

|

Period

|

GSTR 3B Late fees waived if return filed on or before |

|

May, 2020 |

27th June, 2020 |

- Person having aggregate turnover up to Rs. 5 crores in preceding Financial Year (Notification No. 36/2020 – Central Tax 3rd April, 2020)

| Period | GSTR 3B Late fees waived if return filed on or before Aggregate turnover of up to rupees 5 (five) crore rupees in the previous financial year, whose principal place of business is in the States of Chhattisgarh, Madhya Pradesh, Gujarat, Maharashtra, Karnataka, Goa, Kerala, Tamil Nadu, Telangana, Andhra Pradesh, the Union territories of Daman and Diu and Dadra and Nagar Haveli, Puducherry, Andaman and Nicobar Islands or Lakshadweep, the return in FORM GSTR-3B of the said rules for the month of May, 2020 |

| May, 2020 | 12th day of July, 2020: |

| Aggregate turnover of up to rupees 5 (five) crore rupees in the previous financial year, whose principal place of business is in the States of Himachal Pradesh, Punjab, Uttarakhand, Haryana, Rajasthan, Uttar Pradesh, Bihar, Sikkim, Arunachal Pradesh, Nagaland, Manipur, Mizoram, Tripura, Meghalaya, Assam, West Bengal, Jharkhand or Odisha, the Union territories of Jammu and Kashmir, Ladakh, Chandigarh or Delhi, the return in FORM GSTR-3B of the said rules for the month of May, 2020 | |

| May, 2020 | 14th day of July, 2020 |