[highlight txtcolor=”#1e73be”][/highlight]Amendment and Inserted New Serial Number in Tax Audit Report Form 3CD

CBDT issues Notification on amendment of Tax Audit Report.Notification-33-2018 shall come into force from the 20th day of August, 2018. In the Income-tax Rules, 1962, in Appendix II, in Form No. 3CD,-

- Amendment in serial number 4,-

(a) after the words “sales tax,”, the words “goods and services tax,” shall be inserted;

(b) after the words “registration number or”, the words “GST number or” shall be inserted;

2. Amendment in serial number 19, in the table, after the row with entry “32AC”, the row with entry “32AD” shall be inserted;

- Amendment in serial number 24, after the words “32AC or”, the words “32AD or” shall be inserted;

- Amendment in serial number 26, for the words “or (f)”, the words “, (f) or (g)” shall be substituted;

-

Amendment in serial number 31 (C) to 31 (E)

| in serial number 31 (c), in sub-item (v), | for the words “taken or accepted”, the word “repaid” shall be substituted; |

| in serial number 31 (d), in sub-item (ii), | after the words “amount of”, the words “repayment of” shall be inserted; |

| in serial number 31 (e), in sub-item (ii), | after the words, “amount of”, the words “repayment of” shall be inserted; |

-

Amendment in serial number 34 (b)

whether the assessee is required to furnish the statement of tax deducted or tax collected. If yes, please furnish the details:

| Tax deduction and collection Account Number (TAN) | Form Type of Form | Due date for furnishing | Date of furnishing, if furnished | Whether the statement of tax deducted or collected contains information about all details/transactions which are required to be reported. If not, please furnish list of details/transactions which are not reported.”; |

Inserted New Serial Number in Form 3CD

-

Inserted serial number 29 A [section 56(2)(ix)]“

after serial number 29 and the entries relating thereto, the following shall be inserted, namely:-

(a )Whether any amount is to be included as income chargeable under the head ‘income from other sources’ as referred to in [highlight txtcolor=”#1e73be”]clause (ix) of sub-section (2) of section 56? (Yes/No)[/highlight]

(b) If yes, please furnish the following details: (i) Nature of income: (ii) Amount thereof:

-

Inserted serial number 29 B [section 56(2)(X)]

(a) Whether any amount is to be included as income chargeable under the head ‘income from other sources’ as referred to [highlight txtcolor=”#1e73be”]in clause (x) of sub-section (2) of section 56[/highlight]? (Yes/No)

(b) If yes, please furnish the following details:

(i) Nature of income:

(ii) Amount (in Rs.) thereof:”;

(vi) after serial number 30 and the entries relating thereto, the following shall be inserted, namely:-

-

Inserted serial number 30 A [(section 92CE(1)]

(a) Whether primary adjustment to transfer price, as referred to in [highlight txtcolor=”#1e73be”]sub-section (1) of section 92CE,[/highlight] has been made during the previous year? (Yes/No)

(b) If yes, please furnish the following details:-

(i). Under which clause of sub-section (1) of section 92CE primary adjustment is made?

(ii). Amount (in Rs.) of primary adjustment:

(iii). Whether the excess money available with the associated enterprise is required to be repatriated to India as per the provisions of sub-section (2) of section 92CE? (Yes/No)

(iv). If yes, whether the excess money has been repatriated within the prescribed time (Yes/No)

(v). If no, the amount (in Rs.) of imputed interest income on such excess money which has not been repatriated within the prescribed time:

-

Inserted serial number 30 B [ Section 94(1)]

(a) Whether the assesses has incurred expenditure during the previous year by way of interest or of similar nature exceeding 1 crore (one) rupees as referred to in[highlight txtcolor=”#1e73be”] sub-section (1) of section 94[/highlight]B? (Yes/No)

(b) If yes, please furnish the following details:-

(i). Amount (in Rs.) of expenditure by way of interest or of similar nature incurred:

(ii). Earnings before interest, tax, depreciation and amortization (EBITDA) during the previous year (in Rs.):

(iii). Amount (in Rs.) of expenditure by way of interest or of similar nature as per (i) above which exceeds 30% of EBITDA as per (ii) above:

(iv). Details of interest expenditure brought forward as per sub-section (4):of section94B

(v). Details of interest expenditure carried forward as per sub-section (4) of section 94B.

| A.Y. | Amount (in Rs.) |

-

Inserted Serial number 30 C (Section 96)

(a) Whether the assesses has entered into an impermissible avoidance arrangement, as [highlight txtcolor=”#1e73be”]referred to in section 96,[/highlight] during the previous year? (Yes/No)

(b) If yes, please specify: –

(i) Nature of the impermissible avoidance arrangement:

(ii) Amount (in Rs.) of tax benefit in the previous year arising, in aggregate, to all the parties to the arrangement:”;

-

Inserted Serial number 31 (ba) (bb) (bc) (bd) (Section 269ST)

(A) after clause (b), the following clauses and entries relating thereto shall be inserted, namely:-

“(ba) Particulars of each receipt in an [highlight txtcolor=”#1e73be”]amount exceeding the limit specified in section 269ST[/highlight], in aggregate from a person in a day or in respect of a single transaction or in respect of transactions relating to one event or occasion from a person, during the previous year, where such receipt is otherwise than by a cheque or bank draft or use of electronic clearing system through a bank account:-

(i). Name, address and Permanent Account Number (if available with the assesses) of the payer;

(ii). Nature of transaction;

(iii). Amount of receipt (in Rs.); (iv) Date of receipt;

(bb) Particulars of each receipt in an amount exceeding the limit specified in section 269ST, in aggregate from a person in a day or in respect of a single transaction or in respect of transactions relating to one event or occasion from a person, received by a cheque or bank draft, not being an account payee cheque or an account payee bank draft, during the previous year:—

(i). Name, address and Permanent Account Number (if available with the assessee) of the payer;

(ii). Amount of receipt (in Rs.);

(bc) Particulars of each payment made in an amount exceeding the limit specified in section 269ST, in aggregate to a person in a day or in respect of a single transaction or in respect of transactions relating to one event or occasion to a person, otherwise than by a cheque or bank draft or use of electronic clearing system through a bank account during the previous year:-

(i). Name, address and Permanent Account Number (if available with the assessee) of the payee;

(ii). Nature of transaction;

(iii). Amount of payment (in );

(iv). Date of payment;

(bd) Particulars of each payment in an amount exceeding the limit specified in section 269ST, in aggregate to a person in a day or in respect of a single transaction or in respect of transactions relating to one event or occasion to a person, made by a cheque or bank draft, not being an account payee cheque or an account payee bank draft, during the previous year:—

(i). Name, address and Permanent Account Number (if available with the assessee) of the payee;

(ii). Amount of payment (in ); (Particulars at (ba), (bb), (bc) and (bd) need not be given in the case of receipt by or payment to a Government company, a banking Company, a post office savings bank, a cooperative bank or in the case of transactions referred to in section 269SS or in the case of persons referred to in Notification No. S.O. 2065(E) dated 3rd July, 2017)”;

-

Inserted Serial number 36 (A ) [(Section 2 (22)(e)]

after serial number 36 and the entries relating thereto, the following shall be inserted, namely:-

(a) Whether the assessee has received any amount in the nature of dividend as referred to in [highlight txtcolor=”#1e73be”]sub-clause (e) of clause (22) of section 2[/highlight]? (Yes/No)

(b) If yes, please furnish the following details:-

(i). Amount received (in Rs.):

(ii). Date of receipt:”;

-

Inserted Serial number 42 (Form No.61,61a, or 61b)

after serial number 41 and the entries relating thereto, the following shall be inserted, namely:-

(a). Whether the assessee is required to furnish statement in [highlight txtcolor=”#1e73be”]Form No.61 or Form No. 61A or Form No. 61B?[/highlight] (Yes/No)

(b). If yes, please furnish:

| Income-tax Department Reporting Entity Identification Number

|

Type of Form | Due date for

furnishing |

Date of furnishing, if furnished | Whether the Form contains information about all details/ transactions which are required to be reported. If not, please furnish list of the details/transactions which are not reported. |

-

Inserted Serial number 43 ( Section 286 (2)

(a). Whether the assessee or its parent entity or alternate reporting entity is liable to furnish the report as referred to in [highlight txtcolor=”#1e73be”]sub-section (2) of section 286[/highlight] (Yes/No)

(b). if yes, please furnish the following details:

(i). Whether report has been furnished by the assessee or its parent entity or an alternate reporting entity

(ii). Name of parent entity

(iii). Name of alternate reporting entity (if applicable) (iv) Date of furnishing of report

-

Inserted Serial number 44

Break-up of total expenditure of entities registered or not registered under the GST:

| Sl. No.

|

Total amount of Expenditure incurred during the year | Expenditure in respect of entities registered under GST | Expenditure relating to entities not registered under GST | |||

| Relating to goods or services exempt

from GST |

Relating to entities falling under composition scheme | Relating to other registered entities | Total payment to registered entities | |||

| (1) | (2) | (3) | (4) | (5) | (6) | (7) |

Click Here to Other Post

क्या 3 वर्ष से ज्यादा अवधि से बकाया चल रहे, क्रेडिटर्स (Creditors) के बैलेंस को आयकर अधिकारी द्वारा करदाता की आय में जोड़ा जा सकता है ?

तलाशी के दौरान कितने आभूषण और गहनों को जब्त नहीं किया जा सकता है

आयकर कानून के सजा (कारावास) के प्रावधान

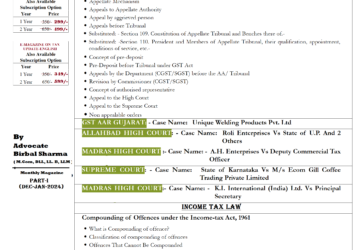

Magazine on Income tax amendments 2018 (Digital Product) Only 10 Rupees

Amend the section 44AE in Finance Bill-2018

Substitution of new Section 80AC budget 2018

(If you liked the Article, please Subscribe)

[email-subscribers namefield=”YES” desc=”” group=”Public”]