Proposed to amend the section 44AE in Finance Bill (Amendment of section 44AE)

Clause 16 of Finance Bill-2018, In section 44AE of the Income-tax Act, This amendment will take effect from 1st April, 2019 and will, accordingly, apply in relation to the A.Y 2019-2020 and subsequent years,(Amendment of section 44AE)—

(a) for sub-section (2), the following sub-section shall be substituted, namely:––

“(2) For the purposes of sub-section (1), the profits and gains from each goods carriage,—

(b) in the Explanation, for clause (a), the following clauses shall be substituted, namely:–

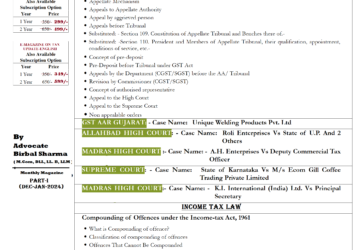

Other Post and Magazine

Magazine on Income tax amendments 2018 (Digital Product) Only 10 Rupees

Salient Features of Tax Proposals Rajasthan Budget 2018-19

mahesh

whats is 44ae limit for ay 2018-19

Advocate Birbal Sharma

Please read this article https://legaltaxguru.com/amendment-of-section-44ae-amend-the-section-44ae-in-finance-bill/