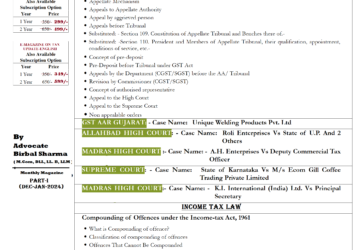

Important Points for GST Return and Late Fees

वार्षिक रिटर्न GSTR- 9,9C की Due Date (GSTR-9 Due Date (2017-2018)m 31st January, 2020. (Order No. 10/2019-Central Tax dated 26th Dec, 2019))आते-आते जीएसटी पोर्टल ने काम करना बंद कर दिया है, तो Due Date बढ़ानी चाहिए कि नहीं ? ज्यादा से ज्यादा शेयर करे और अपनी राय (Twitter) कमेंट में जरूर दे

” Finance Ministry tweeted. “In the view of such huge response, which would lead reduction in unmatched credit, it has been decided to extend the said amnesty scheme (GST Form GSTR-1 of tax periods (Monthly/Quarterly) starting from July, 2017 to November, 2019) from 10th Jan. 2020 to 17th January 2020 By Notification No. 05/2020 – Central Tax,

|

Important dates |

|

|

GSTR-3B Due Date (Dec, 2019) |

20th, January 2019 |

|

CMP-08 Due Date (Oct-Dec, 2019) |

18th, January 2020 |

|

GSTR-1 Due Date(Oct-Dec, 2019) |

31st, January 2020 |

|

GSTR-1(Dec, 2019) Turnover exceeding Rs. 1.50 Crores or opted to file monthly Return |

11th January 2020 |

|

GSTR-9 Due Date (2017-2018) |

31st January, 2020. (Order No. 10/2019-Central Tax dated 26th Dec, 2019) |

|

GSTR-9A Due Date (2017-2018) |

31st January, 2020. (Order No. 10/2019-Central Tax dated 26th Dec, 2019) |

|

GSTR-9C Due date (2017-2018) |

31st January, 2020. (Order No. 10/2019-Central Tax dated 26th Dec, 2019) |

| Important dates | |

|

GSTR-3B(Nov, 2019) |

20th, December 2019 Due date of filing of GSTR-3B for the month of November 2019 has been extended to 23-12.2019. |

|

CMP-08(Oct-Dec, 2019) |

18th, January 2020 |

|

GSTR-5(Nov, 2019) |

20th, December 2019 |

|

GSTR-5A(Nov, 2019) |

20th, December 2019 |

|

GSTR-6(Nov, 2019) |

13th, December 2019 |

|

GSTR-7(Nov, 2019) |

10th, December 2019 |

|

GSTR-8(Nov, 2019) |

10th, December 2019 |

|

GSTR-9(2017-2018) |

31st December -2019 |

|

GSTR-9A(2017-2018) |

31th, December 2019 |

|

GSTR-9C(2017-2018) |

31st December -2019 |

-

Due dates for Form GSTR-9, Form GSTR-9A and Form GSTR-9C – Order No. 10/2019-Central Tax dated 26th Dec, 2019- Extends the last date for furnishing of annual return/GST reconciliation statement (GST Audit Report) in FORM GSTR-9/FORM GSTR-9C for FY 2017-18 till 31st January, 2020.

- late fee payable under section 47 of the CGST Act shall stand waived for the registered persons who failed to furnish the details of outward supplies in GST FORM GSTR-1 for the months/quarters from July, 2017 to Nov. 2019 by the due date but furnishes the said details in GST FORM GSTR-1 between the period from 19th Dec. 2019 to 10th Jan. 2020.”- from 10th Jan. 2020 to 17th January 2020,

-

GST Return Due Date-All taxpayers are required to file return FORM GSTR-3B & pay tax on monthly basis.

- Due date for GST Return GSTR-3B for the month of July 2019 is extended till 20th September 2019 for GST taxpayers having a principal place of business in J & K (Jammu and Kashmir) and certain districts of Bihar, Gujarat, Karnataka, Kerala, Maharashtra, Odisha, and Uttarakhand. and The late fees for July 2019 GST Return GSTR-1(filed monthly) and Form GSTR-6 have been waived off for the gst taxpayers having a principal place of business in certain districts of the flood-affected States -( Bihar, Gujarat, Karnataka, Kerala, Maharashtra, Odisha, and Uttarakhand and all districts of J&K (jammu and kashmir).

- Taxpayers with turnover up to Rs. 1.5 Cr are required to file information in FORM GSTR-1 on a quarterly basis. Other taxpayers would have to file GST Return FORM GSTR-1 on a monthly basis. Note-

Particular Due Date

GSTR-1(Oct-Dec, 2019) Jan 31st, 2020 Turnover exceeding Rs. 1.50 Crores or opted to file monthly Return GSTR-1(Nov, 2019)

Dec 11th, 2019 - On account of difficulties being faced by taxpayers in furnishing the annual returns in FORM GSTR-9, and reconciliation statement in FORM GSTR-9C, the GST Council in its 35th meeting held on 21.06.2019 extended the due date for furnishing these returns/ reconciliation statements for the Financial Year 2017-18 is extended from November 30, 2019 to December 31, 2019.

- Late fee has been completely waived for all taxpayers in case FORM GSTR-1, FORM GSTR-3B & FORM GSTR-4 for the months / quarters July, 2017 to September, 2018 are furnished after 22.12.2018 but on or before 31.03.2019.

- The last date for furnishing statement containing the details of the self-assessed tax in FORM GST CMP-08 for the quarter April, 2019 to June, 2019 (by taxpayers under composition scheme), has been extended from 31.07.2019 to 31.08.2019 Note-Form GST CMP-08 (Composition Dealers) form will be filed every quarterly on or before 18th day of succeeding month of tax period

- the option of payment of tax under notification No. 2/2019- Central Tax (Rate) dated 07.03.2019 is extended to 30.09.2019.

- Earlier, the reverse charge mechanism under sub-section (4) of section 9 of the CGST Act, 2017 and under subsection (4) of section 5 of the IGST Act, 2017 was kept under suspension till 30.09.2019.

- From October 2017 onwards, the amount of late fee for late filing of FORM GSTR-3B payable by a registered person is as follows:

- whose tax liability for that month was „NIL‟ will be 20 rupees per day instead of 200 Rupees per day

- whose tax liability for that month was not „NIL‟ will be 50 rupees per day instead of 200 rupees per day

sangita kumari

useful update